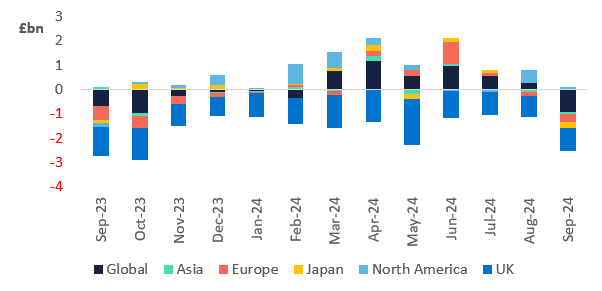

A summer glow came to an end in September, as net retails sales of investment funds saw outflows of £3.4 billion, according to data published by the Investment Association (IA) today.

Following positive net flows in July and August (£1.4 billion and £806 million), September took Q3 net retail sales to a £1.2 billion outflow, which contrasts with the £4.4 billion inflows recorded in the previous quarter.

Key findings for September 2024

- Outflows were heaviest in equities, as investors pulled a net £2.4 billion, a significant increase on the £424 million outflow in August. The only region to remain in inflow was North America, with net retail sales of £101 million, down from £527 million in August.

- Bond fund net flows turned negative with outflows of £116 million, following an inflow of £1.8 billion in August.

- Mixed asset funds saw outflows climb to £534 million, from £192 million in August. September’s figure includes record outflows from the Mixed Investment 40-85% Shares sector of £354 million, as the prospect of CGT rises impacted sectors targeting capital growth as investors anticipated an increased tax take on equity investments held outside ISAs and pension wrappers.

- Inflows to index tracking funds remained high at £1.7 billion, although following a period of very strong sales to index tracking funds inflows were the lowest since October 2023 when net retail sales were £363 million.

- Responsible investment funds saw record outflows of £604 million, exceeding the previous record outflow of £541 million in October 2023.

Key findings for Q3 2024

- UK investor funds under management ended Q3 at £1.497 trillion, down 0.5% on the previous quarter.

- Following positive net flows in July and August (£1.4 billion and £806 million) September’s outflow takes the quarterly net retail sales to a £1.2 billion outflow. This follows a £4.4 billion inflow in Q2.

- Equities dominated Q3 outflows with withdrawals of £2.9 billion. UK equity outflows have remained high at £2.7 billion, though they have declined on the £4.4 billion in Q2.

- Fixed income fund inflows of £2.2 billion in Q3 followed a £382 million outflow in Q2 and were the highest since £2.4 billion in Q1 2023.

- Mixed asset funds saw net outflows of £807 million in Q3, up from £83 million Q2, though remaining below the £1.5 billion outflow in Q1.

- Index tracker inflows have remained consistently strong through 2024, with Q3 inflows of £7.5 billion softening only slightly from the £8.5 billion in Q2.

- Outflows from responsible investment funds accelerated in Q3 to £1.3 billion, from £898 million in Q2.

Equity outflows – more than meets the eye

Following a modest recovery earlier in the year, September saw significant outflows for equities, with investors pulling a net £2.4 billion from the asset class, a substantial increase on the £424 million outflow in August. At a wider level, equites dominated Q3 outflows with withdrawals of £2.9 billion.

With the Labour government’s first Budget impending, much of the shift towards outflows fell on uncertainty around the potential tax changes, including an anticipated hike to the rate of CGT levied on shares that has clearly caused investors pause for thought over allocating to equity funds. The subsequent result of such uncertainty led investors to adjust their portfolio allocations, in what continues to be a complex investing environment.

Across the pond – although North American equities were the only region which saw inflows, stronger than expected economic data from the US, combined with the seemingly very tight election race, has created an uncertain outlook for investors. Investors will also be closely watching today’s interest rate decision from the Fed, which has been tipped to go ahead irrespective of the election result.

Miranda Seath, Director, Market Insight & Fund Sectors at the Investment Association, said:

“In September, investors turned their focus towards the impending Budget as speculation grew around how much the Government would need to borrow and the tough decisions they would take on tax. It was clear that capital gains tax rises were almost inevitable, and this looks to be a contributing factor to a surge in outflows across equities, which has upended the tentative recovery of flows into the asset class in previous months.

“Global equities were particularly impacted, seeing their first outflow in six months. Outflows from UK equities remained consistent with previous months, although we did see a rise in outflows from the UK Smaller Companies sector, which could suggest worsening investor sentiment on the outlook for the UK economy.

“Investors have also been impacted by the uncertainty over Labour’s fiscal strategy, in the drawn out run up to the Budget. The ensuing rise in Gilt yields shows that market reaction to the Budget has been mixed, but not as severe as in September 2022,

“In the longer term, and with the Budget now in the rear-view mirror, there does appear to be some clarity for investors, but only if the Chancellor is able to stick to her commitment to setting long-term and stable fiscal policy, and achieve growth, without raising taxes further. Looking ahead to the final quarter of 2024, Trump’s US election victory will be a more significant factor in the fortunes of markets around the world and investors will be watching closely.”