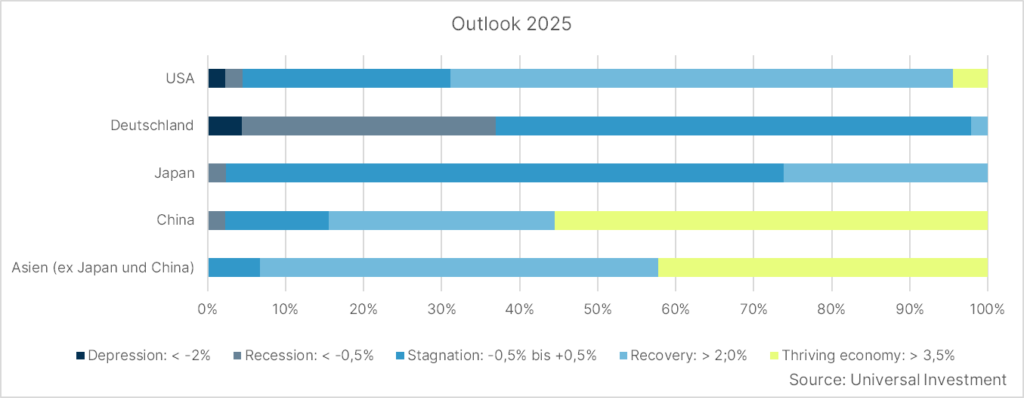

From a global perspective, there is an expectation that the economy will perform well in 2025. Contrary to the opinion of some experts, a clear majority of the 50 respondents to Universal Investment’s annual survey of wealth managers predict an upturn in the US and even a boom in Asia, particularly China. For Europe and Germany, wealth managers surveyed predict recession or stagnation.

Respondents foresee investment risks primarily stemming from the general political climate: 87 per cent consider geopolitical tensions as the biggest threat to capital markets, followed by wars and terrorist attacks (54 per cent). In third place is inflation, coming in at just under 46 per cent despite a positive downward trend which started to take hold this year.

Regulatory risks are considered far more worrying than the ongoing interest rate policy of central banks. Climate change ranks second to last, stated as a risk by 17 per cent, only ahead of supply chain problems which are considered the lowest risk.

Looking at the asset classes and regions wealth managers will be recommending to retail investors in 2025, the survey reveals a clear direction: Respondents recommend an asset class split that is clearly overweight in developed markets, with an ideal equity allocation of of more than 43 per cent and almost 22 per cent in fixed income. Emerging market equities should account for just under 10 per cent and emerging market fixed income for just over 5%. Respondents recommend a 5.5 per cent allocation in real estate, however just over 4 per cent of the total allocation should go towards alternative investments. By comparison, the recommended allocation to gold and precious metals is quite high, at 7.7 per cent %.

More Japan than China

In terms of country allocation, the US tops the investment list with 45 per cent, Europe follows with 30 per cent and Asia, excluding China, with 6,7 per cent. Despite expectations of strong growth in China, only 3.8 per cent recommend allocations in the region – well below that of Japan at 5.5 per cent.

Further rate cuts in the year ahead seem to be factored into wealth managers’ planning. Between 71 per cent and 78 per cent of respondents anticipate lower interest rates for the Federal Reserve, the European Central Bank, and the Bank of England in 2025. The only outlier is Japan, where a clear majority expect interest rates to rise slightly. With a coalition government in place for the first time, Japan’s monetary policy may experience some changes and new momentum.

Pharma outpaces tech

In terms of thematic investments, pharmaceuticals rank highest at 70 per cent, overtaking technology (60 per cent). Cybersecurity (49 per cent) and infrastructure (37 per cent) come in third and fourth, with climate and environment ranking sixth with 23 per cent.

Taking a closer look at sustainability, few other investment approaches have made such a positive start in recent years, making their way onto the political agenda of many countries – and now being under intense scrutiny. Major international asset managers and political decision-makers are pulling back, in some cases significantly.

Interest in sustainable investments cools off

In line with the market as a whole, the wealth manager community surveyed has clear – though varied – views on the topic: almost 35 per cent of respondents expect demand for ESG investments to continue declining, just over 37 per cent anticipate it to remain at current levels, and 21 per cent expect an increase, and. By contrast, only 7 per cent believe that demand will fall dramatically.