Savers are urged to take advantage of competitive returns on longer-term fixed bonds to avoid disappointment. Moneyfactscompare.co.uk reveals the state of play in the fixed bond market for savers.

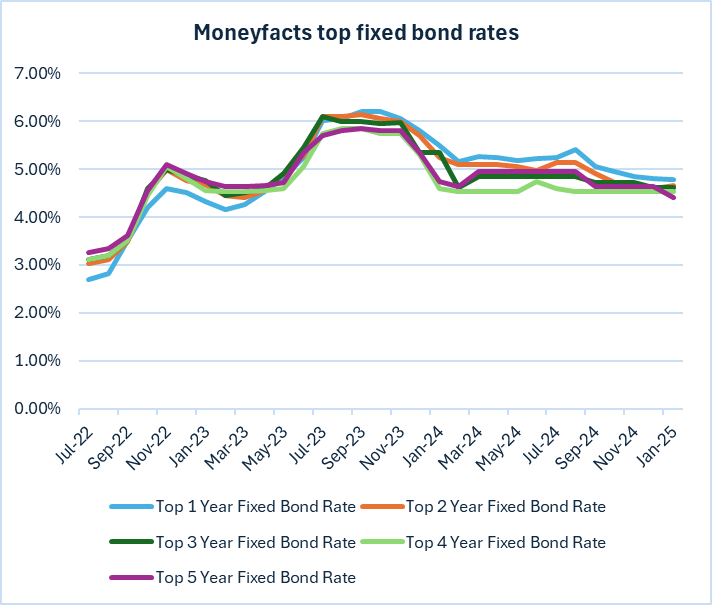

· The top one-year fixed bond fell month-on-month, the top two-year bond rose month-on-month, with the top three-, four- and five-year bonds remaining unchanged

· The top one-year fixed bond fell to 4.79% gross, which is now 0.15% higher than the top five-year fixed bond at 4.64%. The rate gap was 0.16% a month prior.

· In July 2024, the rate gap between the top one- and five-year bonds was 0.30%, as they sat at 5.25% and 4.95%, respectively.

· A year ago, the top one-year bond paid 5.50%, with the top five-year bond paying 5.22%, a gap of 0.28%.

| Savings market analysis – top fixed bond rates | |||||||

| Jul-22 | Jan-23 | Jul-23 | Jan-24 | Jul-24 | Dec-24 | Jan-25 | |

| Top one-year fixed bond rate | 2.70% | 4.33% | 6.02% | 5.50% | 5.25% | 4.80% | 4.79% |

| Top two-year fixed bond rate | 3.03% | 4.56% | 6.10% | 5.40% | 5.13% | 4.60% | 4.65% |

| Top three-year fixed bond rate | 3.11% | 4.76% | 6.10% | 5.35% | 4.85% | 4.61% | 4.61% |

| Top four-year fixed bond rate | 3.11% | 4.55% | 5.75% | 4.93% | 4.60% | 4.54% | 4.54% |

| Top five-year fixed bond rate | 3.25% | 4.75% | 5.70% | 5.22% | 4.95% | 4.64% | 4.64% |

| Top interest rates based on a £10,000 deposit as at the start of the month. | |||||||

| Source: Moneyfactscompare.co.uk | |||||||

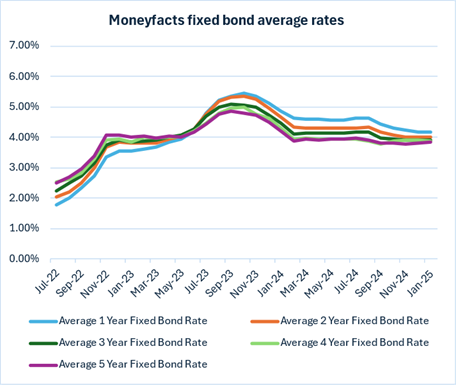

· The average one-year fixed bond at 4.19% gross is now 0.33% higher than the top five-year fixed bond at 3.86%. The rate gap was 0.36% a month prior.

· In July 2024, the rate gap between the average one- and five-year bonds was 0.66%, as they sat at 4.64% and 3.98%, respectively.

· A year ago, the average one-year bond paid 4.87%, while the average five-year bond paid 4.20%, a gap of 0.67%.

| Savings market analysis – average fixed bond rates | |||||||

| Jul-22 | Jan-23 | Jul-23 | Jan-24 | Jul-24 | Dec-24 | Jan-25 | |

| Average one-year fixed bond rate | 1.80% | 3.56% | 4.80% | 4.87% | 4.64% | 4.19% | 4.19% |

| Average two-year fixed bond rate | 2.03% | 3.83% | 4.77% | 4.68% | 4.32% | 4.00% | 4.02% |

| Average three-year fixed bond rate | 2.24% | 3.84% | 4.69% | 4.46% | 4.18% | 3.90% | 3.92% |

| Average four-year fixed bond rate | 2.55% | 3.85% | 4.46% | 4.31% | 3.93% | 3.91% | 3.89% |

| Average five-year fixed bond rate | 2.52% | 4.02% | 4.44% | 4.20% | 3.98% | 3.83% | 3.86% |

| Average interest rates based on a £10,000 deposit as at the start of the month. | |||||||

| Source: Moneyfactscompare.co.uk | |||||||

Caitlyn Eastell, Spokesperson at Moneyfactscompare.co.uk, said:

“Savers who are expecting their two-year fixed bond to mature this year will see that the top returns are not too dissimilar today, which could sway investors to lock in for a shorter one-year term if they are concerned about inflationary pressures. Although shorter-term fixed bonds currently pay higher rates than their longer-term counterparts, there are expectations for base rate cuts this year. Reductions to the Bank of England base rate typically impact variable rates in the first instance but may also influence providers pricing for fixed rate products. Therefore, savers could feel it’s wiser to fix for longer.

“Savers missed out on a rise to the Personal Savings Allowance (PSA) during Labour’s first Autumn Statement in October 2024, so they may well be feeling the pressure. However, consumers should be cautious of their initial investment amounts to avoid potentially breaching the PSA. In any case, investors may wish to seek independent professional advice before locking away their cash and carefully consider the terms and conditions of a fixed rate deal.”