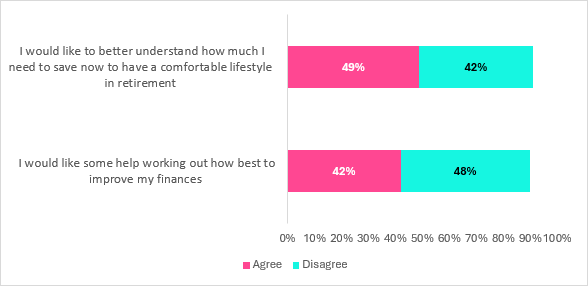

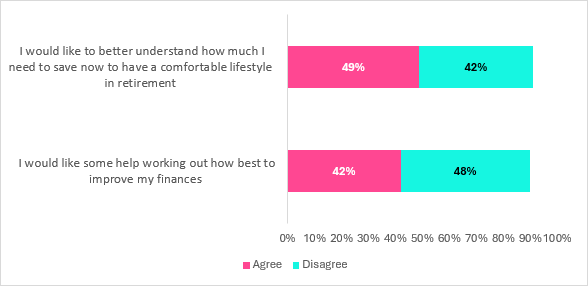

Research from financial technology firm EV in conjunction with Opinium, finds that half (49%) of British adults would like help understanding how much they need to save now to have a comfortable lifestyle in retirement. Those aged between 18 and 34 are far more likely to want assistance (79%), but significant numbers of respondents in older age brackets would also appreciate help (35-54: 58%; 55+: 20%). Additionally, those with higher incomes are most likely to want guidance on retirement saving, with two-fifths (60%) of respondents with income over £50,000 wanting help, but there is demand at all levels of income (up to £20,000: 42%; £20,000-£50,000: 47%).

The 2024 research, among 2,000 British adults, also found that two-fifths (42%) of respondents would like more general help working out how to improve their finances, for instance, paying down their mortgage or investing more for the long-term. This need is more prevalent among younger people, with almost three-quarters (72%) of 18 to 34-year-olds wanting support, but half (50%) of those in the 35 to 54 age bracket also need help. People on higher incomes, over £50,000, are most likely to want assistance (52%), but a significant number of those earning less would also appreciate help (up to £20,000: 36%; £20,000-£50,000: 41%).

The research revealed that friends and family (29%) and banks (20%) are the most popular sources of support, but one in ten (10%) are seeking help from social media, rising to nearly a quarter (23%) of those aged 18 to 34. Over a third (36%) are not getting any help, increasing to more than two-fifths (43%) of those earning £20,000 or less a year.

The research also asked about consumer appetite for digital tools to help with financial decisions and whether the availability of certain functionality would encourage customers to switch to a new provider. Tools for budgeting and saving for retirement were most popular with around a fifth (22% and 21% respectively) saying they would move their current account to a new bank or building society to access them. The 18 to 34 age group was most likely to switch for digital tools (80%), but a significant number of those in the 35 to 54 group would also be encouraged to move (49%). Those with higher incomes were more likely to move (£50,000+: 57%), but there was an appetite to switch for better digital tools at all income levels (up to £20,000: 35%; £20,000-£50,000: 42%).

Andrew Storey, Group Innovation Director at EV, said, “We often hear that young people and those at the lower end of the income scale are most at risk of falling into the advice gap, but our research shows the problem is more widespread. While some people are accessing support from professional financial advisers, many others are resorting to social media or not getting any help at all.

“The FCA’s current review of the advice guidance boundary will hopefully create opportunities for different types of support, and we believe there is huge scope for banks, building societies, pension providers and employers to offer flexible digital guidance tools that can support simple financial decision making, filling the current void and providing an important bridge to more detailed hybrid or traditional advice where needed.”

EV offers an extensive suite of flexible, configurable advice and guidance tools to meet an organisation’s exact needs. With more than 35 APIs based on its proven calculation engine, EV can help financial services providers integrate forecasting tools, affordability calculators and decision engines across retirement, investment, risk suitability and holistic financial planning into their existing technology.