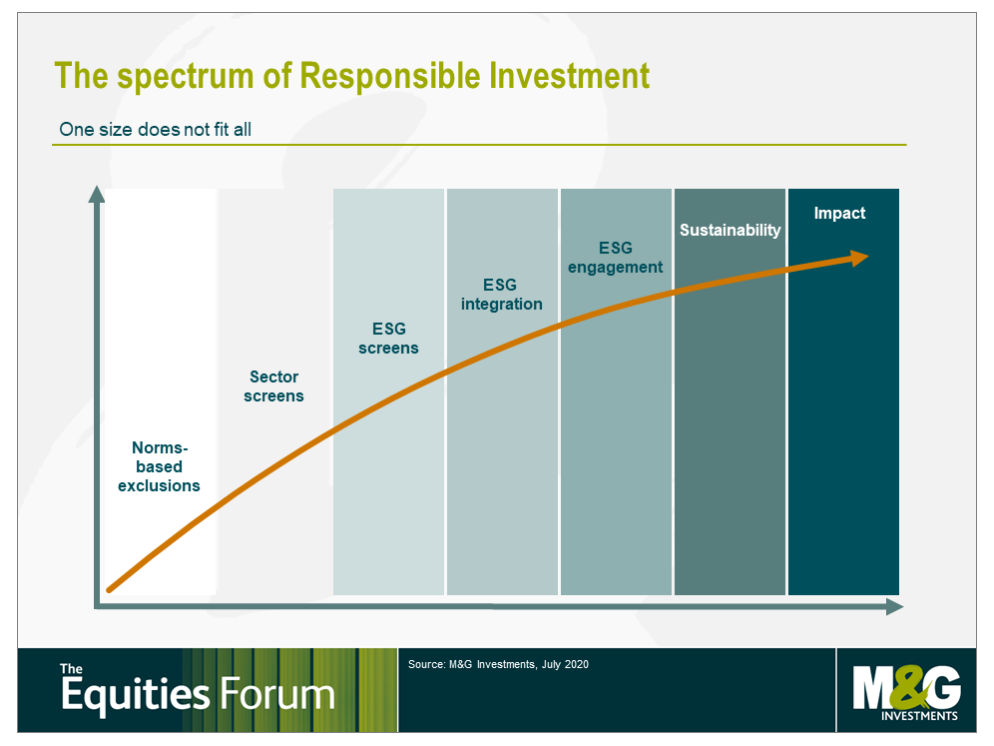

While investors’ knowledge about Responsible Investing has generally improved over the past few years, the increasing diversity of thought in the market has created new layers of confusion. Overall, investors are better equipped to grasp the distinctions between ESG and impact investing, but remain rather perplexed about the differences between sustainable and impact investing, often mixing one with the other. From a distance, sustainable and impact investing appear quite similar. A closer look, however, reveals meaningful differences.

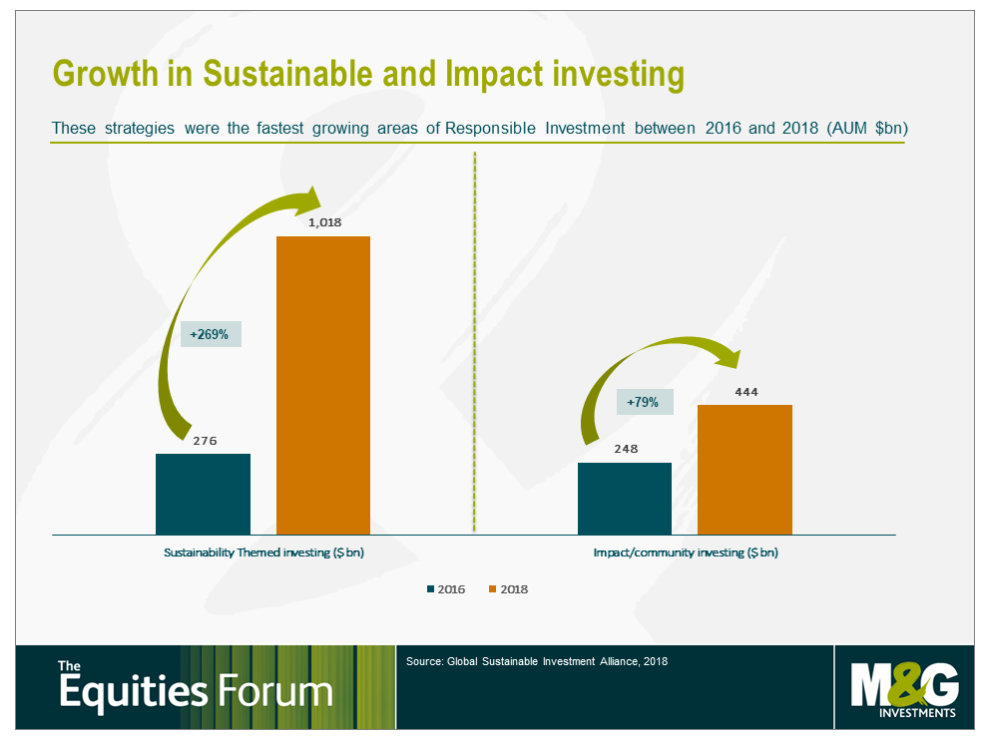

The muddling of definitions isn’t all that surprising considering that sustainability and impact investing has only recently joined the mainstream Responsible Investment spectrum. Both approaches have come to the fore as they cater to investors’ growing appetite for investments that help to combat environmental issues and improve social outcomes. As reported in the most recent Global Sustainable Investment Review, sustainability-focused and impact strategies were the fastest growing areas of Responsible Investment between 2016 and 2018, with AUMs growing at 269% and 79% respectively.

Admittedly, this is from a low base, but the latest survey from the Global Impact Investor Network (GIIN) indicates that growth has been sustained for impact strategies, with the impact market estimated to have grown from $502 billion to $715 billion between 2019 and 2020, or +42%.

The sombre reality of COVID-19 seems to have galvanised even more interest in both types of investments. Although investors have been drawn in by their relative resilience in recent months, the severity of the outbreak has also led to a greater appreciation of the vital role played by company employees, and has shone a light on the breadth and depth of global inequality – prompting a refocus on our communities and the health of our people and planet.

Yet, how do we differentiate between sustainable and impact investing?

Despite the Investment Association’s (IA) best efforts to flesh out a legible ‘Responsible Investment’ framework last year [1], confusion remains stubbornly entrenched and wariness around terminology has not convincingly lifted.

As per the IA’s definition, sustainability refers to investments that fulfil certain sustainability criteria and/or deliver specific and measurable sustainability outcomes. The IA identifies three types of sustainability funds: ‘themed’, ‘best-in-class’ and ‘positive tilts’.

Impact, meanwhile, (endorsing the GIIN’s definition) is described as investments made with the intention to generate positive, measurable, social and environmental impact alongside financial returns.

Sustainability-focused and impact funds have a lot in common…

In contrast with ESG funds, whose emphasis is really on strong operational practices, both sustainability-focused and impact funds go a step further by focusing on economic activities (products and services) that deliver positive outcomes. As such, they often invest in similar sectors such as renewable energy, green technology, clean water, education and healthcare, to name a few.

Continue reading article…

![[uns] house of commons, parliament](https://ifamagazine.com/wp-content/uploads/wordpress-popular-posts/788182-featured-300x200.webp)