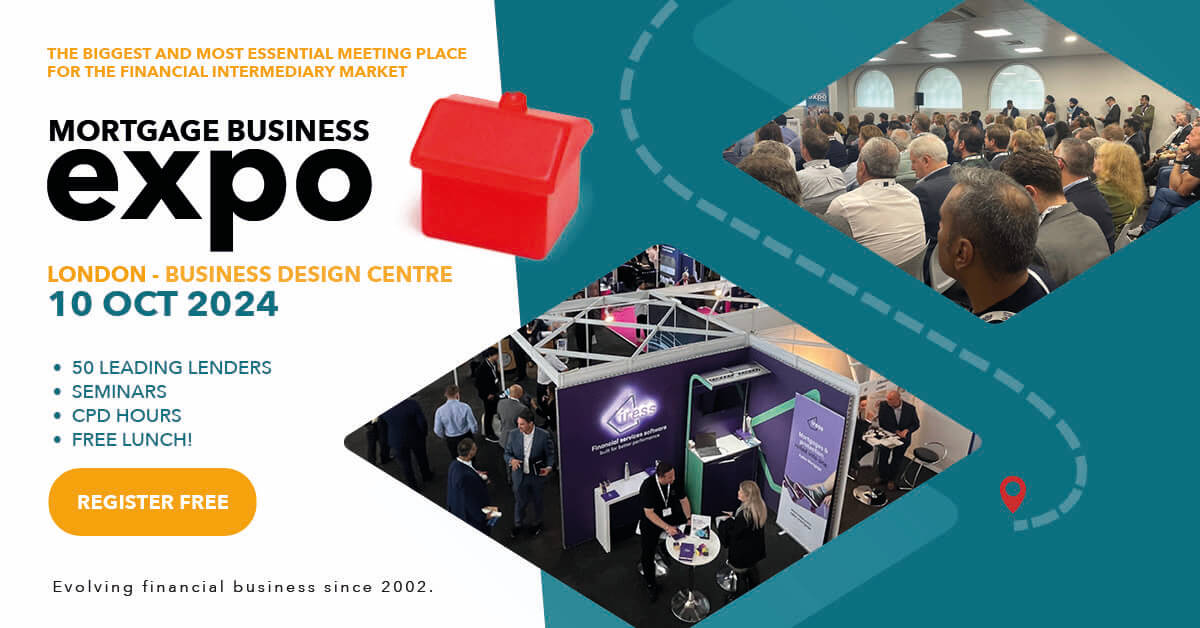

Since its launch in 2002, Mortgage Business Expo (MBE) has grown to become the biggest and most essential meeting place for the financial intermediary market. MBE is a dedicated event for mortgage practitioners and professionals enabling face-to-face conversations with leading lenders, plus the opportunity to level up skills and knowledge in the seminar sessions covering the UK mortgage and specialist lending markets, and much more.

The London event, which takes place on 10th October at the Business Design Centre in Islington, London, will feature a series of seminars specifically designed to add value to the intermediaries in attendance, chaired by Rob Barnard, Director of Intermediary Relationships at Pepper Money.

Sessions will include:

● General Market Overview: What does 2024 tell us about what to expect in 2025?

● Later Life Lending: the challenges and the opportunities

● Residential Mortgages: The ongoing affordability

● Fireside Chat: AR and DA – The merits of each told by two brokers

● The Changing Face of Buy-to-Let

The Financial Intermediary & Broker Association (FIBA), will again be holding their Specialist Property Finance Summit within the MBE day and their sessions will include:

● The role of Bridging and Development Finance

● Expanding Your Business Through Specialist Property Finance

● Green Homes, the future

● AI Revolution in Mortgage Advising: Transforming the Broker’s Role in the Digital Era

In addition, attendees can take advantage of the marketing sessions hosted by Google Digital Garage and the Mortgage Marketing Forum, covering subjects such as digital marketing strategy, being visible on google maps, digital advertising, and being easy to mind and easy to find.

Rob Elder, the Bank of England’s Agent for Greater London, will be once again delivering the keynote address, providing his insights into the current state of the economy and the future outlook for the UK.

There’s a special session on Mental Health in the Mortgage industry delivered by the Mortgage Industry Mental Health Charter, an initiative focused on raising awareness and fostering an environment where no one in our industry suffers in silence.

Visitors can earn CPD hours towards the CII/Personal Finance Society member CPD scheme through attendance.

More information can be found here about joining the list of lenders and putting yourself in front of over 1000 brokers and intermediaries or email the MBE Team here.

It’s free to visit MBE, including a free lunch for all!

Registration in advance is recommended – please register here.