In this analysis, Dimitris Korovilas, Senior Investment Strategist, Vanguard, Europe explains why making large tactical shifts in asset allocation is likely to leave clients further away from their goals.

Flexible, alternative and thematic investment strategies can make for eye-catching headlines in financial media. The question for investors, though, is whether they can consistently deliver long-term value.

Interest rates rose rapidly between mid-2022 and late 2023, in response to soaring inflation across developed economies. This created fertile ground for proponents of flexible investment approaches to make the case for these kinds of investment strategies. The appeal of adaptability amid a fast-changing macroeconomic environment is easy to understand—particularly after equities and bonds fell in tandem through most of 2022.

The reality, however, is that flexible asset allocation solutions take on additional risk by chopping and changing the mix of assets at the portfolio manager’s discretion. Over the long term, investors in flexible funds would hope to be rewarded for the extra risk taken by the portfolio manager. However, Vanguard research finds that flexible Multi-Asset funds fall behind their traditional, strategic asset allocation peers when it comes to risk and reward. Let’s first define exactly what we mean by strategic and flexible Multi-Asset solutions.

The different approaches to Multi-Asset investing

According to the Investment Association’s (IA) definition, flexible funds can invest anywhere between 0% and 100% in equity markets, affording the portfolio manager the freedom to make radical changes to the mix of assets in the portfolio. Fundamentally, flexible funds are unconstrained by their investors’ tolerance for risk; they can shift the portfolio’s combination of assets without limits as and when the manager deems appropriate with the main goal of delivering optimal returns.

Conversely, a strategic approach to asset allocation involves the deliberate division of investments across different asset classes to manage risk over the long term. The mix of assets—typically equities and bonds— is either fixed or limited by a maximum and/or minimum equity market allocation (which Vanguard refers to as time-varying asset allocation or dynamic).

While flexible fund managers can make significant changes in asset allocation, that doesn’t mean they have to. To establish the degree to which flexible funds exercise their freedom to make significant tactical changes to asset allocation, we looked at the maximal difference in equity exposure for funds in each of the IA sectors: cautious (maximum 40% equity), moderate (40%-60% equity), aggressive (at least 60% equity) and flexible (0% to 100% equity) in the 10 years ending 31 December 2023. The analysis found flexible funds recorded the highest average difference in maximum and minimum equity market exposure, with a median difference of 33% compared to 25% for aggressive allocation funds, 23% for moderate and 19% for cautious1. In other words, flexible funds made larger shifts to the mix of assets in the portfolio relative to strategic funds.

The key difference between strategic and flexible Multi-Asset solutions therefore comes down to their approach to risk. Strategic allocation approaches are ultimately risk-aware, whereas flexible approaches are risk-agnostic, so to speak.

The key question here, then, is do the either of these approaches deliver long-term value?

Measuring risk and reward

To measure the value of both approaches we need to look at performance through the lens of risk-adjusted returns. To test this, we looked at annualised 10-year risk-adjusted returns across the four IA sectors. Risk-adjusted returns, as measured by a fund’s Sharpe ratio, essentially show how much return an investor gets for the level of risk taken in the portfolio. The higher the Sharpe ratio, the more favourable the return on investment when factoring in the amount of risk taken. Importantly, risk in this instance refers to the volatility of returns in excess of the local market’s risk-free rate (represented here by the Sterling Overnight Index Average). For example, a portfolio of 100% equities would carry far greater risk than a portfolio with 20% equities, given the higher volatility associated with equity returns relative to bonds and cash.

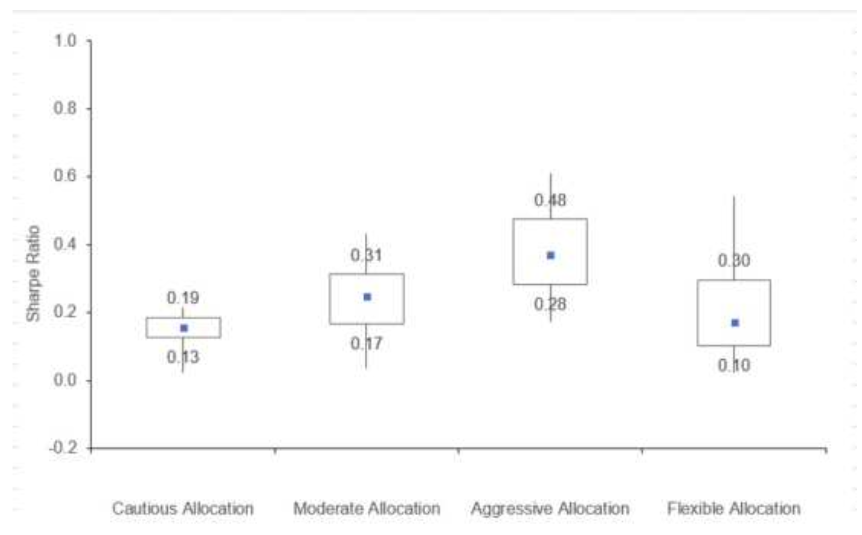

Our analysis breaks each IA sector into five groups according to the distribution of individual funds’ annualised Sharpe ratios for the 10 years ending 31 December 2023. Funds in the 25th percentile, for example, posted lower Sharpe ratios than 75% of the funds in the period observed, while funds in the 75th percentile posted higher Sharpe ratios than 75% of funds in the sample.

Chart 1 shows 10-year annualised Sharpe ratios in the 25th and 75th percentiles, as well as the median, for each of the IA Multi-Asset sectors. Crucially, the median Sharpe ratio is higher for two out of three strategic allocation sectors compared to the IA flexible sector, which scored 0.17 compared with the cautious sector median of 0.16.

Chart 1: strategic allocation tends to deliver better long-term risk-adjusted returns

Distribution of annualised Sharpe ratios

Past performance is not a reliable indicator of future results.

Source: Vanguard calculations based on data from Morningstar (as of end-February 2024). Notes: The fund universe includes Multi-Asset open-end funds and ETFs available for sale in the UK and fall within Investment Association categories cautious (maximum 40% equity), moderate (40%-60% equity), aggressive (at least 60% equity) and flexible (0% to 100% equity). Each fund is represented by its oldest share class. Sharpe ratios are calculated based on annualised risk and return figures in GBP. The risk-free rate is represented by the Sterling Overnight Index Average (SONIA). Equity-exposures are determined monthly. Data between 1 January 2014 and 31 December 2023.

For context, the FTSE All World returned more than 11%2 on an annualised basis over the period analysed, so the higher risk-adjusted returns of the aggressive and moderate sector funds are understandable. The fact that flexible funds only narrowly outscored the median Sharpe ratio of cautious sector funds—which can only invest up to 40% in equity markets—suggests that market timing is difficult to execute well and tinkering with asset allocation isn’t a recipe for long-term investment success.

Deliver long-term value with strategic asset allocation

Flexible Multi-Asset funds may seem appealing to some investors, but our research indicates that a risk-aware approach to Multi-Asset investing tends to deliver a better trade-off for long-term investors. Trying to correctly and consistently time markets through asset allocation is notoriously difficult, even for professional portfolio managers.

Most investors are served best with a long-term, strategic allocation to global equities and global bonds that aligns with their investment goals and tolerance for risk. That’s why Vanguard’s Multi-Asset funds and model portfolios employ a strategic approach to asset allocation—spanning both our index and actively managed funds and model portfolios¬—with a choice of different equity/bond ratios to cater for a variety of investor goals and risk preferences.

1 Vanguard calculations based on data from Morningstar. Data between 1 January 2014 and 31 December 2023.

2 Source: Bloomberg. Returns calculated in GBP with dividends reinvested. Data between 31 December 2013 to 29 December 2023.

To learn more about Vanguard, please click here

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important Information

This document is directed at professional investors and should not be distributed to, or relied upon by retail investors.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Asset Management Limited. All rights reserved.

About Dimitris Korovilas

Dimitris Korovilas, Ph.D. is a Senior Investment Specialist in Vanguard’s Investment Strategy Group, focusing on asset allocation. Prior to joining Vanguard, Dimitris worked as a senior investment specialist for Scientific Beta and as a vice president in the Quantitative Investment Strategies team at Citigroup in London. Dimitris has a BSc from the University of Piraeus in Greece and an MSc and PhD from the ICMA Centre in the UK. His research has been published in the Journal of International Money and Finance and the Journal of Alternative Investments, among others.