Written by Steve Ellis, Global CIO, Fixed Income at Fidelity International

As households replace central banks as buyers of US Treasuries, this is adding to the pressure on longer-dated bonds at a time when issuance is surging. But once disinflationary forces feed through more forcefully to markets, the tide should turn.

The recent sell-off in government bond markets has taken many in the market by surprise, not least because it runs contrary to the direction of travel on inflation. With price growth coming down, long-term bond yields should be peaking.

Instead, we have a sell-off, rooted in some hard realities. The US fiscal deficit has soared this year, abnormally for this late stage in the economic cycle. It is expected to rise sharply again next year, and bond and bill supply will be very high as a result. In the past month, after a summer lull, issuance of government debt has gone through the roof and there is a price to pay for that.

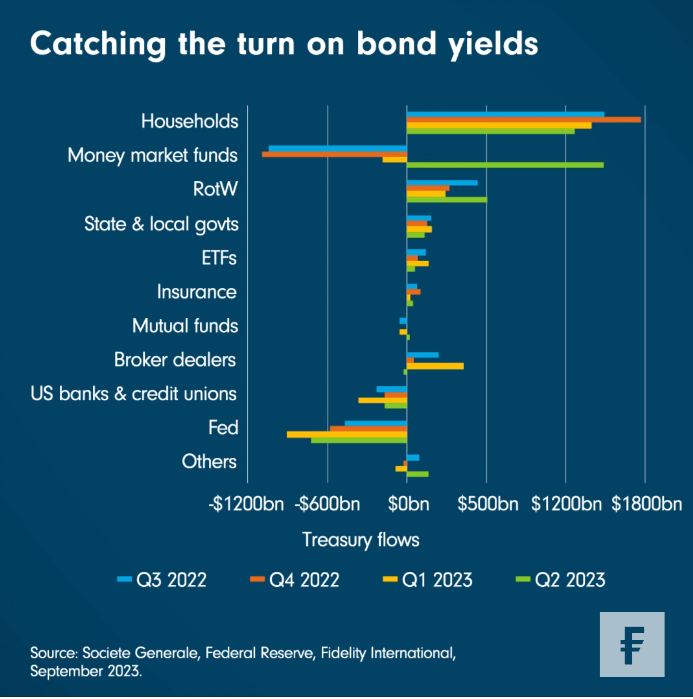

One interesting – and possibly worrying – nuance, which I’ve highlighted for this week’s Chart Room, is that the buyers in the Treasury market have changed. Issuance for years was sucked up by long-term holders – chiefly the Fed itself and other central banks – who were relatively uninterested in the price of what they were buying. As the chart shows, with the spike in yields, the big added buyers of the past year instead are US households and asset managers. Money market fund buying also jumped again in the second quarter, as the troubles at regional US banks this spring underlined how falling bank deposit growth has reduced the demand for duration from commercial banks. All of this will have an impact on 10-year and other longer-dated paper.

There are other things happening. The “higher for longer” mantra is having an impact on broader expectations for rates and the term premium for longer-dated paper. Chinese and Japanese buying of Treasuries has dipped, in part due to the high cost of FX hedging but also probably because of some long-term reserve diversification.

What will all this mean for US yields? We are discovering again that bonds are not functioning as an equity diversifier. There is and will be demand for them, but it will come at a price. The US is suffering from endemic fiscal deficits, and rising interest costs only add to the headline deficit. The fiscal trends are unsustainable, and that’s before we confront what could still turn out to be a hard recession next year.

That all supports the market’s current discounting of bond prices. Yet the fact that it is discounting means it will eventually find a bottom. We are still heading towards a downturn, one that should slash inflation, demand a pivot of some kind from the Fed, and create a turning point for bond markets. But we aren’t there just yet.