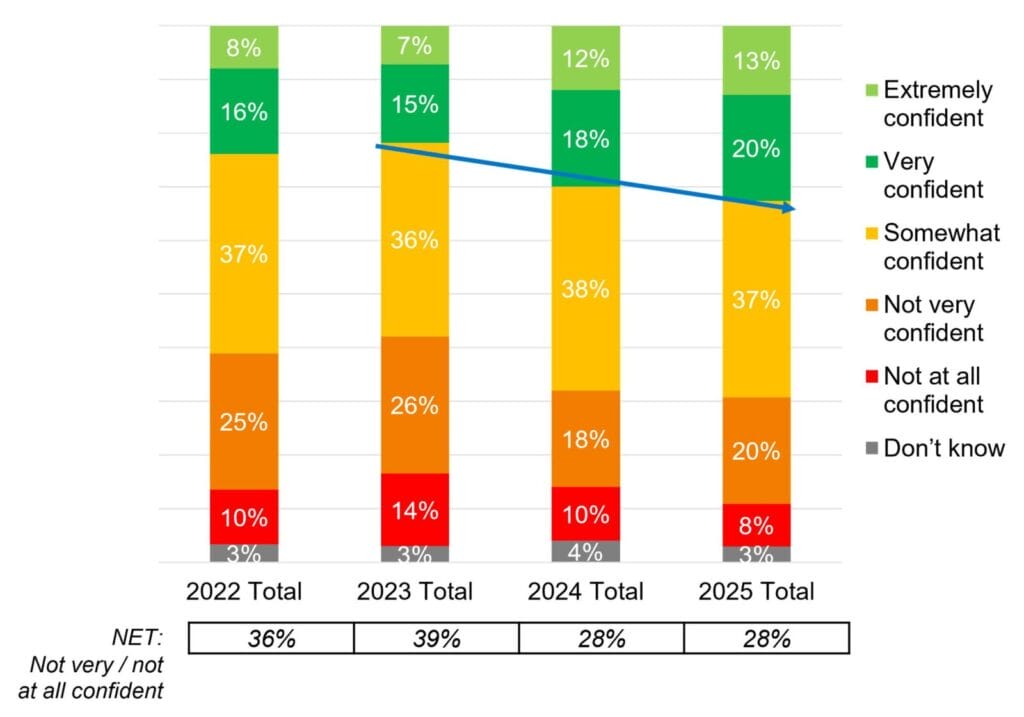

Confidence in retiring comfortably is on the rise, with 33% of UK workers now saying they feel very or extremely confident about achieving a lifestyle they consider comfortable in retirement.

This 2025 Second 50 research from Aegon marks a significant upward trend from 22% in 2023 and 30% in 2024, reflecting growing optimism about long-term financial wellbeing.

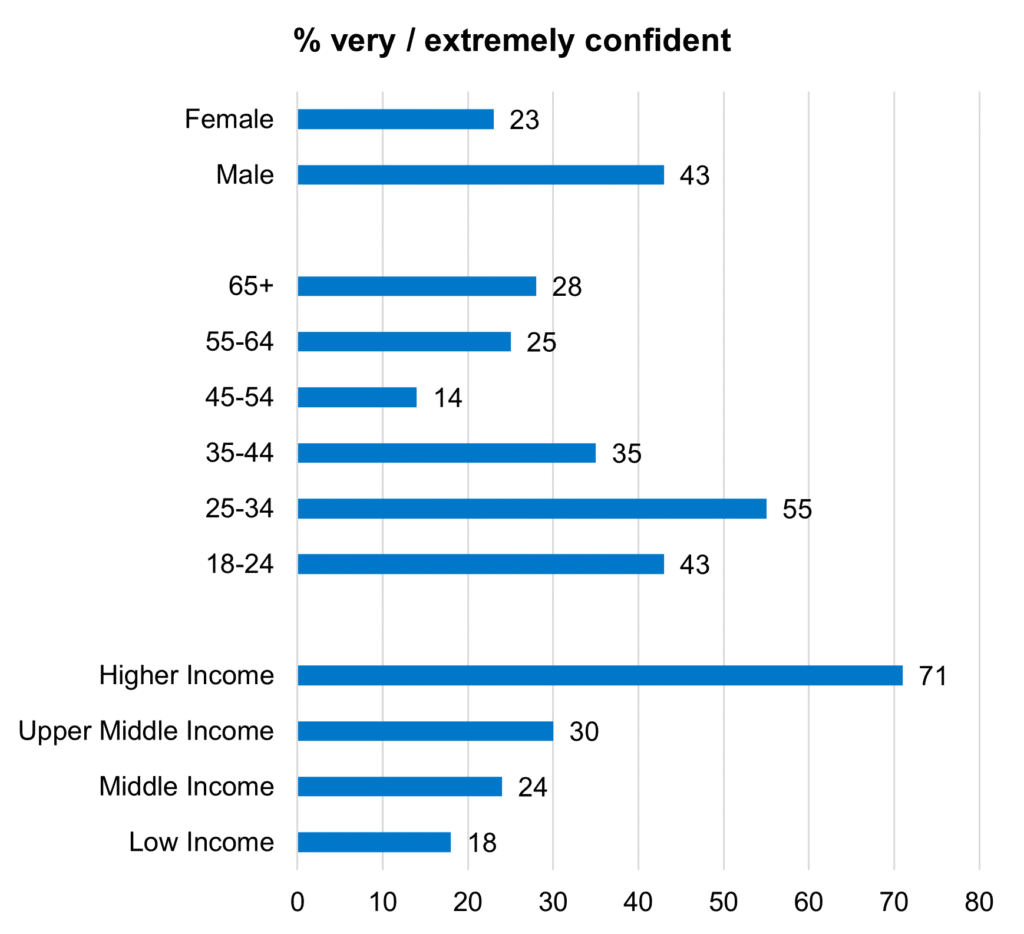

The findings also reveal notable disparities across age, gender and income groups. Confidence is highest among younger workers and men, with 55% of 25-34-year-olds and 43% of men expressing high confidence, compared to just 23% of women and only 14% of 45-54-year-olds.

Confidence levels by income bracket show a stark contrast: just 18% of low-income workers feel confident about retiring in comfort, compared to 71% of higher-income earners.

The findings are part of Aegon’s Second 50 initiative, a campaign which aims to empower individuals to take control of their financial wellbeing as they enter and move through mid and later life.

Commenting on the findings, Steven Cameron, Pensions Director at Aegon, said:

“It’s encouraging to see confidence in retiring comfortably improving year-on-year. This improvement could reflect the broader economic trends we’ve seen in recent years, including earnings growth rising faster than inflation, inflation easing from its peak, and interest rates steadying.

“But it’s also clear from our results that this optimism isn’t shared equally. Women and lower-income workers continue to report significantly lower confidence, which points to persistent challenges and also highlights the importance of further industry support and engagement.

“It’s vital that individuals have access to help to prepare financially for the second half of their lives. Better insights and taking control are vital to help close these confidence gaps. That starts with access to the right tools, education, guidance and advice. The FCA’s new targeted support could add a further option for many.

“These confidence gaps reflect age-old challenges in how we approach financial planning and retirement. Aegon’s Second 50 offers a positive starting point for tackling some of the deeper challenges in retirement planning. It’s about recognising that we all have different and evolving hopes for retirement in a changing world. Retirement for today’s workers will be very different from previous generations, often involving working and living active lives for longer than our parents or grandparents. Being able to picture your ‘retirement self’ can help you take control and start to build greater confidence.

“By working together – government, employers, individuals and the pensions industry – we can create more opportunities for individuals, whatever their circumstances, to take control of their financial future and feel more confident about their retirement.”