For professional investors only. Capital at risk

Inflation dynamics flipped the traditionally negative equity-bond correlation on its head in 2022, creating headaches for investors with 60/40 portfolios. We believe this was particularly painful for ‘lower’ risk investors who typically had greater duration in what are often described as ‘risk-free’ assets such as government bonds. While the equity-bond correlation became negative again at various points throughout 2023, we have also continued to see sell-offs where both asset classes move in tandem. These periods are often characterised by a shift towards the ‘higher-for-longer’ inflation narrative and hawkish central bank moves that are likely to reoccur if inflation remains volatile.

Some commentators, having observed these recent trends, proclaimed the death of diversification, yet we would caution against such a blunt approach. Much like with the succession of a new monarch, when one era ends there will be some degree of change, but the underlying principles on which the institution exists tend to endure. We believe this is a relevant metaphor to the principles for investing, so while investors may need to rethink their approach to diversification, it would be unwise to ditch it altogether, in our view.

A diversification dethroning?

From the early 1990s until 2021, the correlation between equity and bond returns had typically been negative. That changed last year. In 2022, all asset classes except cash and commodities delivered a negative performance. Why the change, and is this the new normal?1

The equity-bond correlation is typically driven by economic shocks. Aggregate demand shocks tend to drive cashflow expectations and discount rates in the same direction. Generally, bond and equity prices tend to be inversely correlated in response to such shocks. In contrast, aggregate supply shocks tend to drive inflation up and output down. For a nominal bond, higher inflation would reduce the value of its cashflows, likely also resulting in a fall in bond prices.

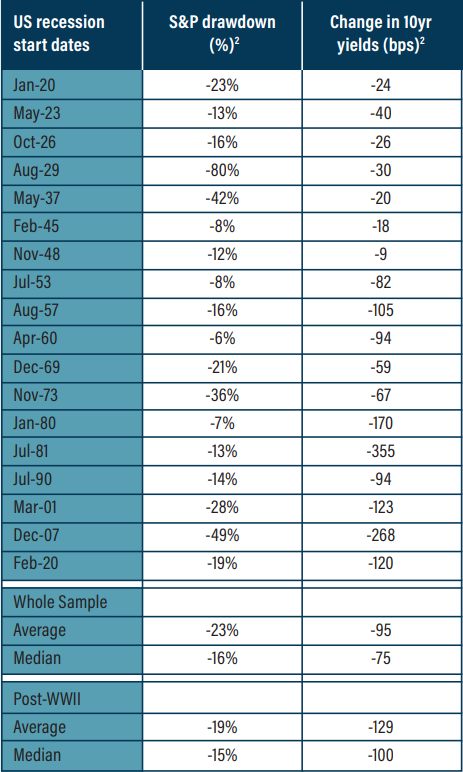

In our view, the correlation between equities and bonds will be determined by which of these shocks dominates, and history has demonstrated that bonds have remained one of the most reliable assets to help fortify portfolios in a recessionary environment, as the below table demonstrates.

This is why the question of whether we are in a temporary period of high equity-bond correlation, or a structural ‘new era,’ is important. On balance, we lean towards the former, but acknowledge some more structural inflationary factors that could mean we won’t fully return to the golden age of equity-bond correlation.

Heavy is the head that wears the equity crown

With the stability of the equity-bond correlation thrown into question, we must place an even greater level of scrutiny on the level of diversification within each asset class. We believe this is particularly important within equities, as not only does the asset class often account for the largest component of risk within a portfolio, but there are also concentration risks within equities that are particularly acute.

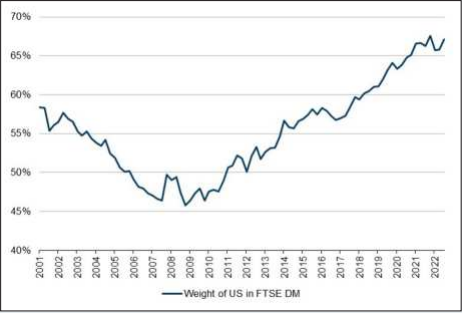

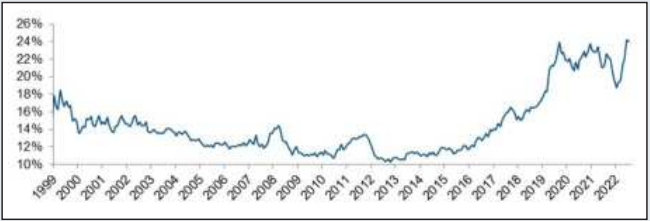

Over the course of the past decade or so, we have seen the weight of US stocks in global developed market (DM) equity indices increase significantly. As illustrated in the below graph, this means that US equities now make up roughly two-thirds of global DM equities.

Source: Bloomberg as at 30 June 2023. Past performance is not a guide to the future. The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested.

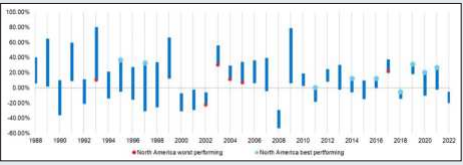

Source: Bloomberg analysing annual returns between 1987 and 2022. Comparison of MSCI Gross Return Indices for North America, UK, Europe, Japan, Asia ex-Japan and Emerging Markets. Past performance is not a guide to the future.

If we were to allocate to DM equities based on market capitalisation, this would lead to roughly two-thirds of our developed market equity allocation being invested in one region. Beyond simply looking at market capitalisation, we do not believe there is any reason that this should be our starting point when constructing a portfolio.

Strong relative performance from US equities has led to this large weighting in the index, but we do not believe this will necessarily be sustained in the future. As the below chart shows, the US has been the best-performing region globally for much of the past decade, but this was not always the case. In fact, there were several years historically where it was the worst-performing region.

Additionally, we have long been worried about the stock concentration level in US equities. As the below table shows, the top five stocks in the S&P 500 Index now make up around a quarter of the index. This means that the largest stocks in the index now drive an inordinate proportion of its returns.

Source: Bloomberg, as at 31 December 2022. The value of any investment and any income taken from it is not guaranteed and can go down as well as up, and investors may get back less than the amount originally invested.

We find this market dynamic uncomfortable and are unwilling to allow a few stocks to have such a meaningful impact on the outcomes of our portfolios. We therefore seek to favour a more diversified approach within our regional equity allocations, meaning we typically have more exposure to other DM regions than our peers, and less exposure to US stocks.

This isn’t to say that we are predicting the US will do badly, or that the largest companies will disproportionately underperform; it’s just accepting those risks exist and that if we diversify more by region, sector and company we can combat that concentration conundrum and aim to deliver a more balanced portfolio over the longer term.

A Royal sterling flush

Currencies can also play a role in diversifying portfolios. We think of sterling as an intermediate risk currency, being riskier than the US dollar, yen and euro. This means we believe that sterling is more likely to sell off in a crisis and that holding foreign currencies can lessen some portfolio risk.

Consequently, we prefer less overall hedging for sterling portfolios compared to euro, US dollar or Swiss franc investors. Beyond the global market risks, foreign currency exposure can help to shield against domestic risks that investors are typically exposed to. We believe that such exposure is another diversification tool we have at our disposal as portfolio managers.

Correlation coronation

We strongly believe that the principles of diversification within multi-asset portfolios hold true just as much now, as they have done over the last few decades. However, we appreciate that cross-asset correlation will likely behave differently in the current market regime, when compared with the post global financial crisis decade of benign growth and inflation.

As such, we must work harder to understand potential concentration risks and seek out appropriate levels of diversification across the entire portfolio.

While diversification may no longer operate in the same way as during the last decade, we strongly believe that its inherent principles live on in this new market regime.

Click here to find out more about LGIM

Key Risks

It should be noted that diversification is no guarantee against a loss in a declining market. The value of investments and the income from them can go down as well as up and you may not get back the amount invested. Past performance is not a guide to future performance.

Important information

The information in this document is for professional investors and their advisers only. This document is for information purposes only and we are not soliciting any action based on it. The information in this document is not an offer or recommendation to buy or sell securities or pursue a particular investment strategy and it does not constitute investment, legal or tax advice. Any investment decisions taken by you should be based on your own analysis and judgment (and/or that of your professional advisors) and not in reliance on us or the Information.

This document does not explain all of the risks involved in investing in the fund. No decision to invest in the fund should be made without first reviewing the prospectus, key investor information document and latest report and accounts for the fund, which can be obtained from https://fundcentres.lgim.com/.

This document has been prepared by Legal & General Investment Management Limited and/or their affiliates (‘Legal & General’, ‘we’ or ‘us’). The information in this document is the property and/ or confidential information of Legal & General and may not be reproduced in whole or in part or distributed or disclosed by you to any other person without the prior written consent of Legal & General. Not for distribution to any person resident in any jurisdiction where such distribution would be contrary to local law or regulation.

No party shall have any right of action against Legal & General in relation to the accuracy or completeness of the information in this document. The information and views expressed in this document are believed to be accurate and complete as at the date of publication, but they should not be relied upon and may be subject to change without notice. We are under no obligation to update or amend the information in this document. Where this document contains third party data, we cannot guarantee the accuracy, completeness or reliability of such data and we accept no responsibility or liability whatsoever in respect of such data.

This financial promotion is issued by Legal & General Investment Management Limited. Registered in England and Wales No. 02091894. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No. 119272.

Legal and General Assurance (Pensions Management) Limited. Registered in England and Wales No. 01006112. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, No. 202202.

LGIM Real Assets (Operator) Limited. Registered in England and Wales, No. 05522016. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No. 447041. Please note that while LGIM Real Assets (Operator) Limited is regulated by the Financial Conduct Authority, it may conduct certain activities that are unregulated.

Legal & General (Unit Trust Managers) Limited. Registered in England and Wales No. 01009418. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No. 119273.

© 2023 Legal & General Investment Management Limited, authorised and regulated by the Financial Conduct Authority, No. 119272. Registered in England and Wales No. 02091894 with registered office at One Coleman Street, London, EC2R 5AA