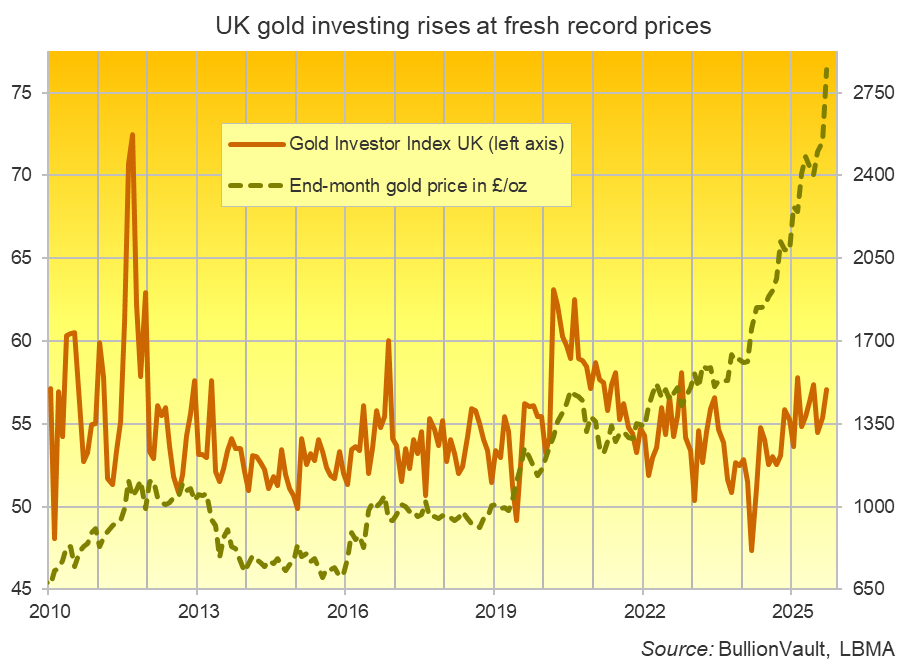

UK gold investing has jumped as bullion prices run to fresh all-time highs near £3,000 per ounce, with world-leading precious metals marketplace BullionVault seeing the largest number of new UK users since the Covid Crisis five years ago.

Now caring for a record £5.3 billion of precious metals for 120,000 users worldwide, BullionVault in September saw the most new UK account openings since April 2020, with the number of first-time investors jumping 87.6% from the previous month and more than tripling from the count in September last year, rising by 213.5%.

“In 20 years of operation, BullionVault has never been busier except in the all-out crises of 2008, 2011 and 2020,” says director of research Adrian Ash at the West London fintech.

“Lehman’s crash, the debt and rioting crisis of 2011, and the Covid lockdowns were clear and immediate emergencies, spurring huge demand for gold,” says Ash. “This year’s gold rush, in contrast, comes without any panic in the wider financial markets.

“Instead, gold has jumped to new record prices as global equities and Bitcoin also hit new all-time highs. This move to hedge against inflation signals long-term anxiety over currency debasement and the size of government debts.”

BullionVault in September saw its UK Gold Investor Index − a unique measure of private investing sentiment derived solely from actual trading behaviour − rise by 1.7 points from August to read 57.1, the strongest level since June.

Tracking the number of UK-resident buyers versus sellers across the month, the UK Gold Investor Index would read 50.0 if they balanced each other exactly. It set a decade peak of 63.1 in March 2020 as the pandemic lockdowns began, and it set a series low of 47.3 four years later on a surge of profit-taking.

This September’s rise took the UK index 3.6 points above the rest-of-the-world’s measure, the widest margin since the Eurozone debt crisis, US debt downgrade and English riots of August 2011.

Says Ash:

“When you have establishment names like Morgan Stanley telling investors that they don’t own enough gold, it’s no surprise to see inflows jump, whether into vaulted bullion of ETF trust funds. Even the coin and retail bar market is finally finding new demand, albeit with continued heavy profit-taking by existing owners.”

Overall on BullionVault − where investors buy and sell gold held in large, securely stored wholesale-market bars, slashing costs with 24/7 access − global client demand was offset by client sales for the third month in a row in September. That kept the total quantity of gold belonging to BullionVault users just below 44 tonnes, now worth a record £4.0bn.

“After jumping on Trump’s US trade tariffs shock this spring, gold prices are now surging again as the White House attacks Fed independence over interest rates,” says Ash.

“But bullion is far from only a Dollar story right now, rising sharply and setting new highs for investors everywhere. Trump’s return to the Oval Office has clearly triggered this year’s surge in precious metals prices, his policies only highlight the need for investors and savers to hedge against inflation, but he didn’t create it.”