AJ Bell has reported that HMRC is to hike late payment interest to 8.5% from 6 April 2025, with the gap between what it charges taxpayers in late payment interest and the rate it offers on overpaid tax wider than ever. New FOI obtained by AJ Bell reveals HMRC has seen a surge in the late payment interest on income tax it has received in recent years, with over £150 million paid so far for the 2022/23 tax year and the average payment up 14% on 2021/22 to £103.33. Charlene Young, senior pensions and savings expert at AJ Bell, comments on the potential windfall for HMRC that this change may bring as follows:

“Buried in the publications following the chancellor’s Spring Statement last week was confirmation of the hike in late payment interest rates that will apply from 6 April this year.

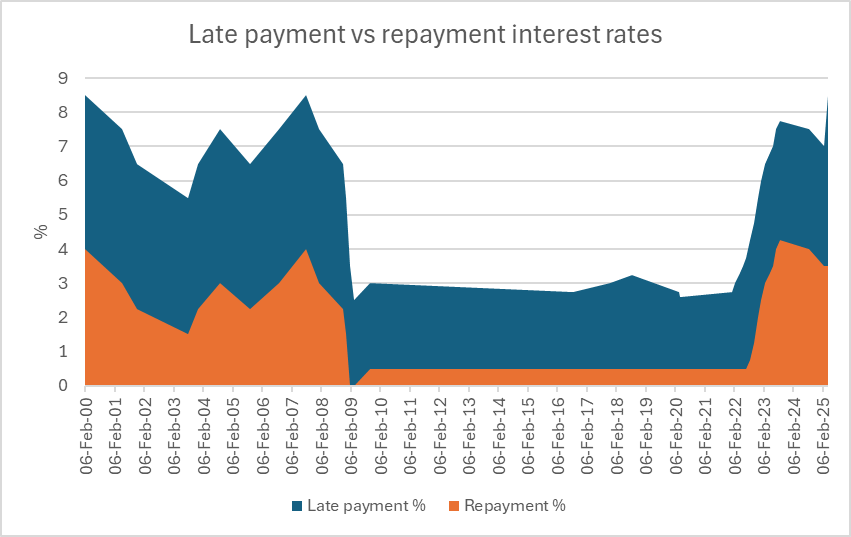

“In her October Budget, the chancellor gave the green light for HMRC to up the interest penalty that can be charged from the Bank of England’s base rate plus 2.5% to the base rate plus 4%, meaning it will stand at 8.5% from 6 April 2025. In contrast, HMRC will continue to only pay base rate minus 1% on repayments owed to taxpayers, equivalent to 3.5%.

“HMRC can still also give themselves more time to pay compared to taxpayers. That’s because late interest is chargeable immediately, yet the repayment supplement only kicks in if HMRC are a year late.

“According to a freedom of information request by AJ Bell, the taxman has so far raked in over £150 million in late payment interest on income tax in the tax year 2022/23 and the average interest payment has jumped to £103.33.

Late interest payments on income tax self-assessment

| Tax year | Number of people paying late payment interest | Total amount paid (£) | Average interest payment (£) |

| 2019/20 | 1,400,000 | 96,800,000 | 69.14 |

| 2020/21 | 1,740,000 | 120,600,000 | 69.31 |

| 2021/22 | 1,740,000 | 157,700,000 | 90.63 |

| 2022/23* | 1,470,000 | 151,900,000 | 103.33 |

Source: HMRC, AJ Bell. *These figures, including any subsequent revisions, are calculated only once the interest accrued or late filing penalty has been paid. It is therefore likely that the figures for 2022/23 will eventually be revised upwards.

“Taxpayers can get their fees and charges waived, but only if they meet a certain list of excuses from the taxman. Simply not knowing that you needed to file a return or not understanding how to are not enough, you only get a refund if you have things like illness or a relative’s death that prevented you from filing, or your computer breaking when you were sending your return.”

Source: AJ Bell/HMRC

How late fees work:

You’ll get a penalty if you need to send a tax return, and you miss the deadline for submitting it or paying your bill. You’ll pay a late filing penalty of £100 if your tax return is up to three months late, but you’ll have to pay extra fees if it’s later, or if you pay your tax bill late.

For unpaid tax, a 5% fine applies after 30 days, with an extra 5% after six and twelve months. You’ll also be charged interest on late payments. This will be base rate plus 4% in late payment interest from 6 April 2025, meaning the interest charge will be 8.5% from the due date until the payment date.