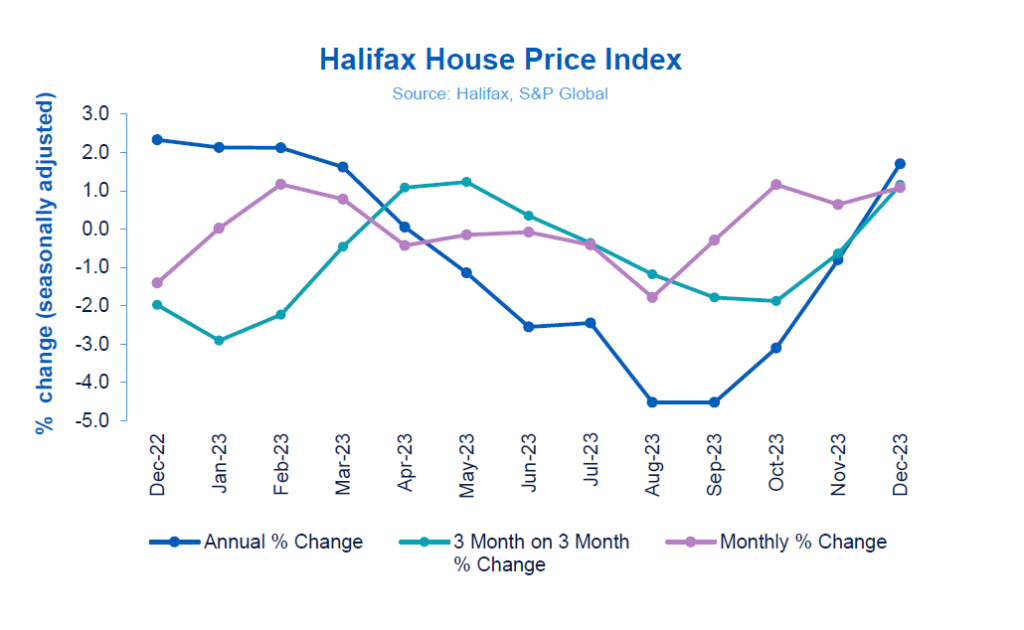

Average house prices rose by +1.1% in December, the third monthly rise in a row whilst property prices grew +1.7% overall in 2023 meaning a typical UK home now costs £287,105.

Kim Kinnaird, Director, Halifax Mortgages, said: “In December, the cost of an average UK home rose for the third month in a row to £287,105, up +1.1% or £3,066, compared to November, reaching the highest level since March 2023.

“The housing market beat expectations in 2023 and grew by +1.7% on an annual basis. The average property price is now £4,800 higher than it was in December 2022. Whilst it’s encouraging that we saw growth in the last three months of the year, this was preceded with property price falls for six consecutive months between April and September. The growth we have seen is likely being driven by a shortage of properties on the market, rather than the strength of buyer demand. That said, with mortgage rates continuing to ease, we may see an increase in confidence from buyers over the coming months.

“Across all the UK regions, Northern Ireland recorded the strongest house price growth in 2023, as properties increased by +4.1% to £192,153. Scotland saw property prices increase by +2.6% to £205,170. At the other end of the scale, the South East fell most sharply, houses there now average £376,804 (-4.5%), a drop of -£17,755.

“As we move through 2024, the UK property market will continue to reflect the wider economic uncertainty and buyers and sellers are likely to be naturally cautious when considering making a move. While wage growth is now above inflation, helping to ease cost of living pressures for some and improving housing affordability, interest rates are likely to remain elevated for as long as inflation remains markedly above the Bank of England’s target. Our latest forecast suggests house prices could fall between -2% and -4% during the coming year, although, as with recent years, forecast uncertainty remains high given the current economic climate.”

Nations and regions house prices

Northern Ireland continues to be the strongest performing nation or region in the UK, with house prices increasing by +4.1% on an annual basis. Properties in Northern Ireland now cost on average £192,153, which is £7,595 higher than the same time in December 2022

Scotland’s average house price also recorded growth, with the average property in the nation now £205,170, +2.6% higher or £5,277 in cash terms on an annual basis. North West (+0.3%), and Yorkshire and Humber (+0.1%) saw modest house price increases over the last year.

The South East fell the most during 2023, when compared to other UK regions, with homes selling for an average £376,804 (-4.5%), a drop of £17,755.

Unsurprisingly, London retains the top spot for the highest average house price across all the regions, at £528,798, albeit prices in the capital have declined by -2.3% on an annual basis.