New analysis from ARC Research shows private client portfolios continued to perform strongly in Q3, but sentiment among CIOs towards bonds has reversed amid interest rate uncertainty.

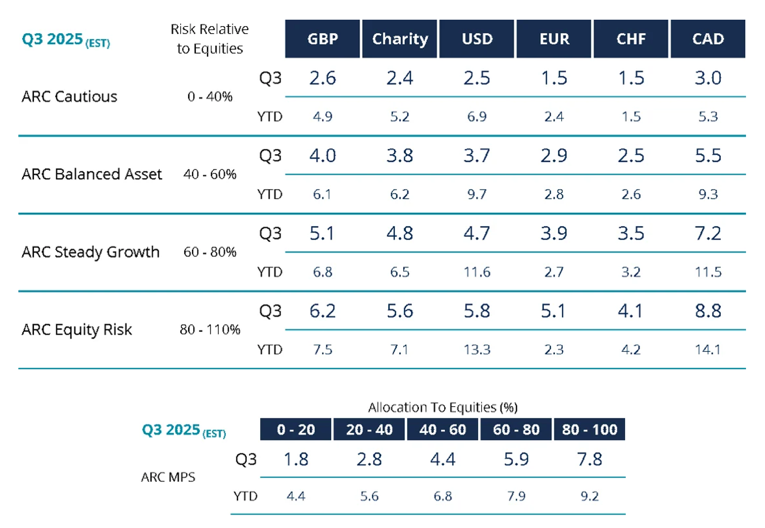

According to ARC Research’s latest data, the average return of the ARC Sterling Steady Growth Index (based on the most common risk profile run by discretionary investment managers) is estimated to have been 5.1 per cent in Q3, taking year-to-date performance to 6.8 per cent.

The figures coincide with ARC Research’s latest sentiment survey of more than 90 CIOs, which shows that wealth managers are still navigating an uneasy balance of assets. Bonds, once the strongest area of conviction, have seen the sharpest reversal as optimism has faded amid uncertainty about the path of interest rates. The outlook for equities remains broadly resilient, slipping only marginally from 12 months ago.

Sentiment towards alternatives has strengthened, with renewed support for gold and commodities. Cash is still viewed negatively, though the degree of pessimism has eased as some managers keep liquidity in reserve amid ongoing inflation uncertainty.

Dan Hurdley, Managing Director, ARC Research, says: “While equities remain in favour, under the surface sentiment towards the US has cooled from positive to neutral, reflecting concerns over valuations and policy risk. By contrast, Europe, Japan, the Far East and emerging markets are attracting stronger support as managers look for relative value and more attractively priced growth dynamics.”