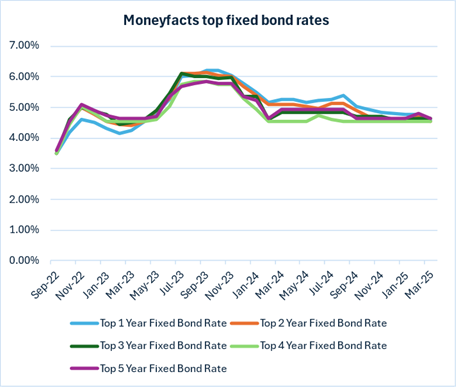

Market-leading short-term bonds continue on a downward trend, with one-year bonds falling by 0.19% – the largest margin in six months. Moneyfactscompare.co.uk reveals the state of play in the fixed bond market for savers.

· The top one-, two- and five-year fixed bonds fell month-on-month, with the top three- and four-year bonds remaining unchanged.

· The top one-year fixed bond fell to 4.58% gross, which is 0.06% lower than the top five-year fixed bond at 4.64%. The top one-year bond rate was lower than the top five-year bond a month prior by 0.03%.

· In September 2024, the rate gap between the top one- and five-year bonds was 0.41%, as they sat at 5.05% and 4.64%, respectively.

· A year ago, the top one-year bond paid 5.26%, with the top five-year bond paying 4.95%, a gap of 0.31%.

| Savings market analysis – top fixed bond rates | |||||||

| Sep-22 | Mar-23 | Sep-23 | Mar-24 | Sep-24 | Feb-25 | Mar-25 | |

| Top one-year fixed bond rate | 3.50% | 4.26% | 6.20% | 5.26% | 5.05% | 4.77% | 4.58% |

| Top two-year fixed bond rate | 3.49% | 4.40% | 6.13% | 5.10% | 4.90% | 4.70% | 4.53% |

| Top three-year fixed bond rate | 3.50% | 4.50% | 6.00% | 4.85% | 4.72% | 4.63% | 4.63% |

| Top four-year fixed bond rate | 3.50% | 4.53% | 5.85% | 4.54% | 4.54% | 4.54% | 4.54% |

| Top five-year fixed bond rate | 3.61% | 4.63% | 5.85% | 4.95% | 4.64% | 4.80% | 4.64% |

| Top interest rates based on a £10,000 deposit as at the start of the month. | |||||||

| Source: Moneyfactscompare.co.uk | |||||||

· The average one-year fixed bond rate at 4.16% gross is now 0.20% higher than the average five-year fixed bond at 3.96%. The rate gap was 0.28% a month prior.

· In September 2024, the rate gap between the average one- and five-year bonds was 0.63%, as they sat at 4.43% and 3.80%, respectively.

· A year ago, the average one-year bond paid 4.61%, while the average five-year bond paid 3.94%, a rate gap of 0.67%.

| Savings market analysis – average fixed bond rates | |||||||

| Sep-22 | Mar-23 | Sep-23 | Mar-24 | Sep-24 | Feb-25 | Mar-25 | |

| Average one-year fixed bond rate | 2.33% | 3.69% | 5.35% | 4.61% | 4.43% | 4.21% | 4.16% |

| Average two-year fixed bond rate | 2.51% | 3.81% | 5.32% | 4.31% | 4.19% | 4.06% | 4.02% |

| Average three-year fixed bond rate | 2.72% | 3.92% | 5.09% | 4.15% | 3.99% | 3.97% | 3.96% |

| Average four-year fixed bond rate | 2.84% | 3.99% | 4.97% | 3.97% | 3.77% | 3.98% | 3.99% |

| Average five-year fixed bond rate | 2.95% | 3.99% | 4.86% | 3.94% | 3.80% | 3.93% | 3.96% |

| Average interest rates based on a £10,000 deposit as at the start of the month. | |||||||

| Source: Moneyfactscompare.co.uk | |||||||

Caitlyn Eastell, Spokesperson at Moneyfactscompare.co.uk, said:

“Savers will be disappointed to see that both short- and long-term market-leading fixed rate bonds have experienced harsh cuts by up to 0.19% over the past month, with the average one-year fixed bond rate seeing a notable drop. Those who are still sitting on the fence about investing their cash in a fixed bond would be wise to make a move soon as rates could tumble further. Despite impacting variable rates in the first instance, the Bank of England base rate cut in February could be partly to blame for fixed rate bond cuts. However, some providers have been adjusting their market positions in both directions, showing there is still a need for deposits to fund their future lending goals. In more positive news, challenger banks continue to dominate the leading positions, leaving savers spoilt for choice if they want to spread their investments across different brands.

“Many economists expect that interest rates will continue to come down this year, and to add insult to injury, inflation is expected to temporarily rise to 3.7% in Q3 2025. Savers locked in for longer and waiting for their fixed bond to mature will need to prepare themselves as they can expect to be left worse off in real terms when they come to re-invest if interest rates continue on the downward path.”