Vanguard’s Advisory Research Centre (ARC), today launched the inaugural Client Connect: Vanguard Advice Survey 2025. Based on responses from over 1000 advised investors and 200 financial advisers across the UK, the study compares preferences, expectations and perceptions on the value of financial advice.

Fabrizio Zumbo, Senior Specialist, ARC and lead author on the report commented: “Our research highlights that investors want advisers who go beyond the numbers – who invest time in them, understand their goals, and are present for the moments that matter.

“Many advisers already put relationships at the heart of their service, but there is always more the industry can do, particularly on delicate topics like legacy planning.”

Investors value financial advice

Advised investors deeply appreciate the value of financial advice, with 93.6% recognising their adviser had made a meaningful difference to the health of their portfolio. Previous Vanguard research suggests advisers can add circa 3% to an investors net return. Encouragingly, in the Client Connect survey UK investors report their advisers are doing even better than that – the weighted average perceived alpha is 6.5%.

However, the value of advice extends well beyond investment performance. 78.2% of advised investors feel confident in reaching their long-term goals thanks to their adviser, and 76.2% say their adviser boosts their mental and emotional wellbeing. Financial security is a deeply personal topic, and investors see their advisers as a source of reassurance and peace of mind, not just returns.

Advisers might not always understand what investors value about advice

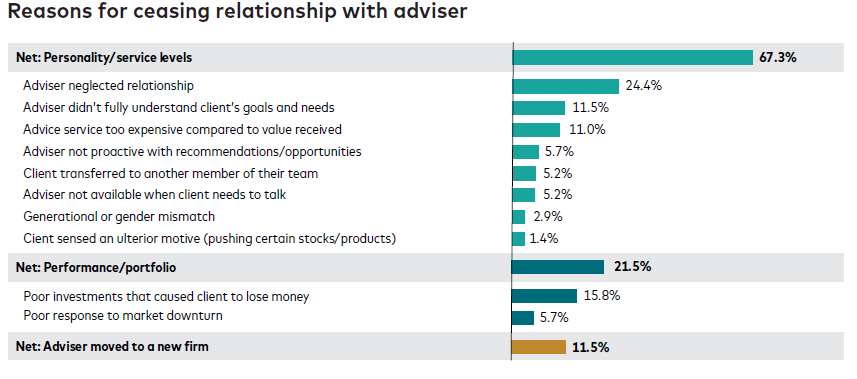

Despite this, there are areas of misalignment between what investors want, and what advisers deliver. While 15.8% of clients report leaving due to poor investment results, 24.4% cite neglected relationships as the primary reason for leaving their adviser (see Figure 1 below).

Personalisation and human connection are critical drivers of strong adviser-client relationships. Advisers (98.1%) and investors (92.5%) agree that a “human to talk to” is more important than investment performance. However, only 29% of advisers report meeting clients more than once a year in person, while 46% of investors say they would like to meet their adviser more than once a year.

Figure 1:

Source: Vanguard, 2025. Advisers were asked: Please rank the top 3 most likely reasons for your clients to cease the relationship with you?

The great disconnect over the great wealth transfer.

Miscommunication is most evident, however, in the context of the upcoming great wealth transfer. With approximately £7 trillion set to be exchanged between generations over the next three decades, legacy planning is a key component of advice.

The research indicates that children often do not consider their parents’ financial adviser when they inherit. Only 28% of investors surveyed believe their children will continue the relationship with their adviser after their death. 53% of advised investors said they wanted wealth transfer conversations to begin earlier in the adviser relationship, ideally in their 40s and 50s, whereas advisers said they tend to begin legacy planning conversations with their clients only when they are in their late 50s and 60s.

Engagement gaps also persist with the families of clients. Only 3.8% of advisers report meeting the children of their clients frequently, despite 28% of investors expecting their children to continue the adviser relationship. Advisers cite lack of interest from heirs as a barrier, suggesting there is work to do on both sides to make for a more constructive dialogue.