More than half of the UK population (56%) have applied for a financial product online in the last 12 months. And of those who did so, 82% have a condition or experience which makes them more likely to be vulnerable to harm.

Under the FCA’s new Consumer Duty rules, coming into play in July, financial services providers will have a regulatory duty to avoid causing foreseeable harm and drive good outcomes for customers, especially vulnerable ones.

However, almost half (49%) of those consumers who have undertaken a financial journey online – which might include applying for a current account or a credit card, renewing a mortgage, or setting up an ISA -either didn’t get what they needed, or aren’t sure they got what they needed from that financial services experience; an ambiguous or poor outcome, not a good one.

This finding comes from brand new research from consultancy Newton Europe. Newton’s new report, The Vulnerability Void, delves into the landscape of neurodiversity and vulnerability in financial services. The term Vulnerability Void refers to the chasm of poor outcomes that vulnerable customers are more likely to fall into; being under-banked, under-insured, and over-exposed to financial risk including debt. Businesses who fail to fix the Void are at risk of less satisfied customers, higher costs, and regulatory consequences.

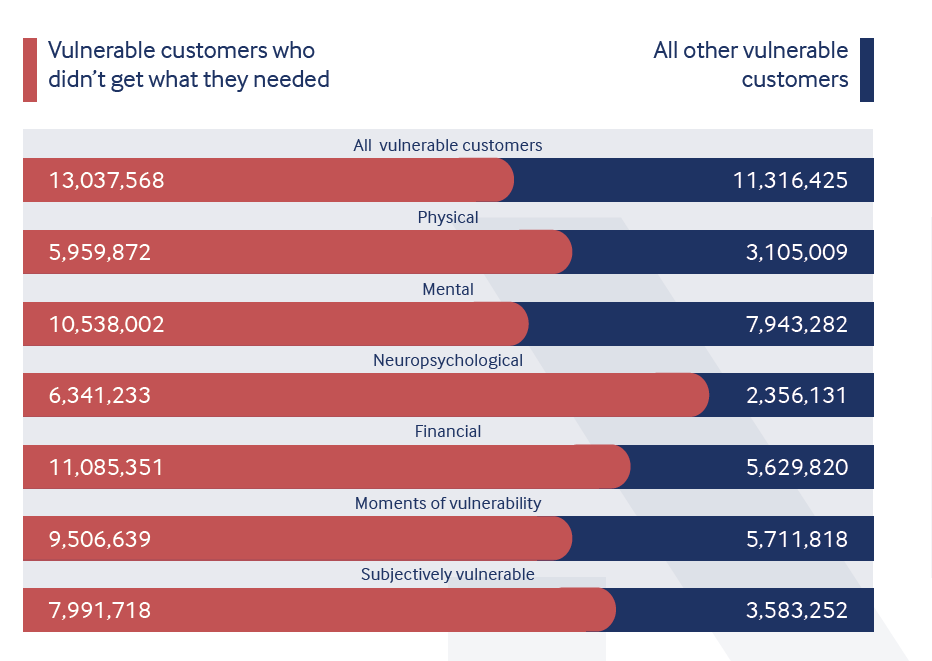

Newton’s research reveals that 90% of these customers facing poor outcomes have vulnerable characteristics. Tallied up to reflect the UK population at large, this infers that 13 million potentially vulnerable customers, who applied for new products via digital channels in the last year, didn’t get or aren’t sure they got what they needed from that experience.

These poor outcomes are attached to approximately £41bn in vulnerable customers’ money; specifically, their balances attached to the respective products generating said outcomes.

Vulnerable customers who took out debt products – loans, overdrafts, mortgages, credit cards – or started investing in the last 12 months are disproportionately more exposed to the Consumer Duty risks of ambiguous outcomes than lower risk deposits.

Delving into types of vulnerability, there is a relatively consistent proportion of vulnerable customers exposed to Consumer Duty risk, but people with neuropsychological conditions are an especially large challenge for providers. Critically, customers with more overlapping characteristics of vulnerability are more likely to be exposed to Consumer Duty risk than those with fewer characteristics.

But the Vulnerability Void isn’t only impacting customers; it is damaging business profitability too. Newton surveyed almost 600 senior decision makers in UK retail financial services firms, and discovered that of those customers with poor outcomes, around 1.4 million, or 11%, found the digital journey difficult, and ultimately abandoned the online experience or sought out the product from a different provider. This means poor digital journeys cost providers around £34.6m in revenue over 12 months.

Junaid Mujaver, partner at consultancy Newton, comments:“Most customers, old and young, vulnerable and not, prefer digital channels when using financial services. Yet vulnerable customers are often neglected when designing mobile and website journeys, whether that’s taking out a new product or managing finances day to day. This has resulted in the alarming reality of the Vulnerability Void; vulnerable customers getting worse outcomes and being financially harmed as a result.

“There has of course been significant investment in digital journeys by financial services organisations, but they are still not fundamentally designed to account for vulnerability and how people process information differently. For example, they often use complex financial terms, don’t account for cognitive fatigue, and inadvertently raise alarm instead of awareness about risks – resulting in disengagement or missing opportunities to reinforce good practice.

“This poses a significant challenge for design teams; there are lots of vulnerabilities to consider and lots of types of customers to cover. It’s critical that firms use robust and proven methods like cognitive and behavioural psychology to assess, review, and solve the issues. This in turn helps organisations to get the most out of their digital investments, reduce fall out and provide better outcomes for vulnerable, and all, customers; it’s win, win, win.”

Newton has just launched NOVA, the Newton Online Vulnerability Assessment, a framework which assesses online journeys. It incorporates leading accessibility best practice and behavioural psychology to help organisations feel confident that their digital journeys are adhering to the industry regulatory requirements for all forms of vulnerability, including neurodiversity.